Welcome to Healthcare Real Estate Fund

Position your capital where demographic certainty meets institutional-grade real estate discipline. Healthcare Real Estate Fund is a short‑duration, three-and-a-half-year income vehicle built to generate predictable cash flow from mission‑critical medical office assets without the decade‑long lockups common in traditional private funds.

Every day, millions of patients walk into medical offices for routine checkups, urgent care, medical screenings, and outpatient surgeries. Those same doors open to a different kind of visitor—you, the investor seeking resilient income and near‑term liquidity.

Quarterly Cash Flow, Institutional Returns

Pension funds and REITs have dominated this space for decades. Healthcare Real Estate Fund levels the playing field—packaging institutional rigor, triple‑net stability, and defensive sector dynamics into a vehicle tailored for accredited private investors.

Our investors receive quarterly distributions targeted at 4 % – 5 % annually, supported by long‑term triple‑net leases to credit‑worthy healthcare providers. A 11.5 % preferred return ensures you get paid first, while a targeted 12 % – 13.25 % IRR captures the upside of a sector that historically outperforms through every economic cycle.

Built‑In Stability, Passive Simplicity

Our properties are secured by long‑term triple‑net leases to credit‑worthy health systems and physician groups. Tenants invest heavily in specialized interiors and rarely relocate, which supports consistent occupancy and rent growth. Because all taxes, insurance, and operating costs pass through to the tenant, investors receive fully managed, genuinely passive income without day‑to‑day headaches.

Your capital works quietly in the background while you focus on what matters. Let the consistency of healthcare revenue power your portfolio. Enjoy cash flows backed by essential, non‑cyclical services. Invest in a sector built to deliver steady dividends through every market cycle.

Partner with Us and Explore the Opportunity

The Healthcare Real Estate Fund unites real estate investors, our expanding physician network, and passive capital in a diversified portfolio of mission-critical medical office properties. By joining our network, you gain:

- Collaborative Insights: Tap into our physician partnerships to understand which markets and specialties are expanding, helping guide fund strategy and asset selection.

- Diversified Exposure: Participate in a professionally managed, triple-net-leased portfolio that spreads risk across multiple markets and tenant types, rather than a single building.

- Passive Participation: Benefit from consistent, recession-resilient cash flow without direct property management—ideal for investors seeking reliable income and healthcare professionals looking to diversify beyond clinical practice.

Whether you’re a real-estate veteran, a healthcare provider interested in expanding your portfolio, or a passive investor seeking stable returns, register now to learn how to become part of our network. Receive fund details, insights on upcoming webinars, and priority consideration when our next investment window opens.

Ready to learn more? Click below to join the Healthcare Real Estate Fund community and discover how our short-duration, income-focused structure can align your capital with a sector driven by essential demand and disciplined growth

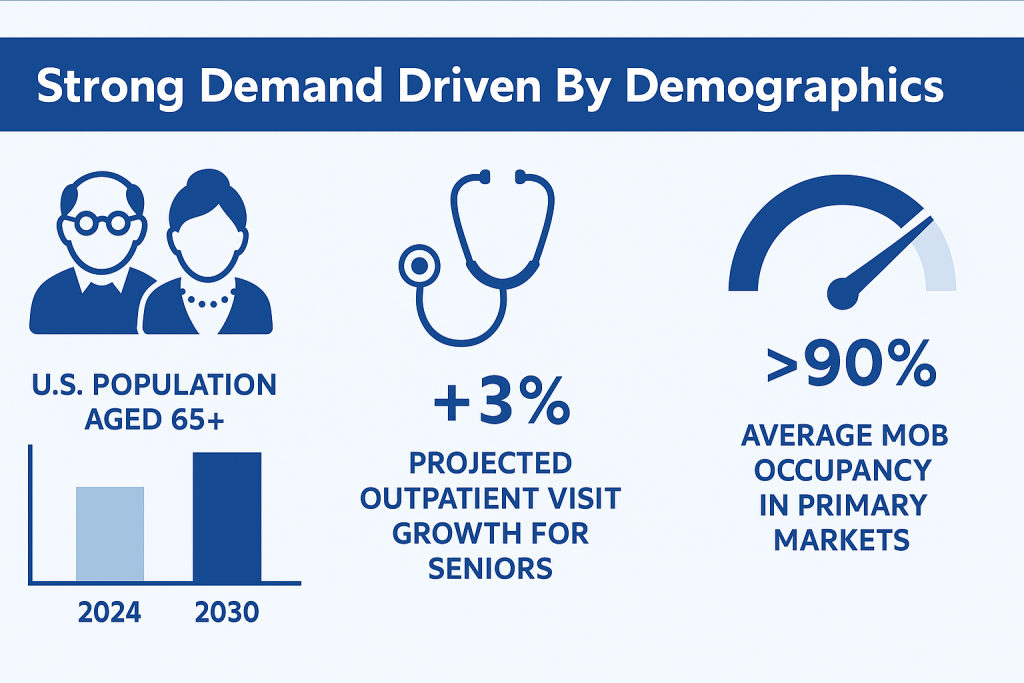

Strong Demand Driven By Demographics

The fundamental, long-term driver of increased healthcare demand is the significant growth of the elderly population. This demographic shift ensures a continued need for healthcare services, which requires physical real estate facilities to deliver that care.

The single most powerful long‑term driver of healthcare real estate is the aging and rapidly enlarging senior population. By 2030, more than 70 million Americans will be 65 or older, representing one resident in five. Within that cohort, the 80‑plus segment will nearly double over the next decade. Older adults consume outpatient services at three to five times the rate of working age adults, generating a structural surge in clinic visits, diagnostic imaging, therapy sessions, and minor surgical procedures that must occur in dedicated medical space. The Centers for Medicare & Medicaid Services already projects national health expenditures to climb past 6 trillion dollars before the decade ends, with outpatient spending rising fastest. In practical terms, the system will register tens of millions of incremental physician encounters each year—encounters impossible to service without additional exam rooms, procedure suites, and specialty clinics.

Demographics intersect with medical progress in ways that compound real estate demand. Breakthroughs in joint replacement, cardiology, oncology, and regenerative medicine allow treatments that once required hospitalization to be performed safely in ambulatory settings, and seniors are the chief beneficiaries. Every new therapy shifted to outpatient care frees hospital beds yet simultaneously adds stress to the existing inventory of medical office buildings, many of which are already operating above 90 percent occupancy in prime metros. This combination of volume growth plus site migration produces a durable need for modern, technology-ready facilities—precisely the property type Healthcare Real Estate Fund investors can participate in.

For multifamily and traditional commercial investors evaluating a pivot into healthcare, demographics offer clarity rarely found elsewhere. Apartment demand can ebb with job losses; retail can soften with e‑commerce pressure. In contrast, the inexorable aging of the Baby‑Boom generation creates a demand curve that is both steep and predictable. Unlike elective lifestyle spending, physician visits and chronic‑disease management are nondiscretionary, underpinned by Medicare and private‑insurance reimbursement. That translates into income stability and resilience across market cycles. Doctors reading this will recognize the pattern firsthand: panels are growing, appointment backlogs lengthen, and expanding square footage—or relocating into state‑of‑the‑art space—becomes essential to meet patient expectations. Capitalizing on these demographic certainties positions investors to harvest steady cash flow while providing critical infrastructure for America’s evolving healthcare needs.

By aligning with Healthcare Real Estate Fund, you gain exposure to the demographic megatrend reshaping healthcare delivery, creating long-term value by serving a need that cannot be delayed or outsourced.

Recession Resilient & Defensive Sector

Healthcare is considered a fundamental need, making its demand less sensitive to economic cycles compared to many other real estate sectors. This provides stability for investors, particularly during economic downturns.

Healthcare real estate stands out as one of the most recession-resilient asset classes in the broader commercial property market. Unlike offices that may sit vacant after corporate layoffs or retail centers vulnerable to shifts in discretionary spending, medical office buildings (MOBs) house mission-critical services. People don’t stop seeing their doctors during a downturn—they often visit more frequently. Chronic conditions, preventative care, surgeries, and follow-ups continue regardless of economic fluctuations, and are largely funded by insurance programs like Medicare, Medicaid, and employer-sponsored plans. That funding insulation helps explain why MOB collections remained over 95% even during the depths of the COVID-19 pandemic and the 2008 financial crisis.

For real estate investors, especially those migrating from sectors like multifamily or retail, the healthcare asset class provides a unique buffer. In multifamily, rising interest rates and wage stagnation can compress margins. In hospitality, occupancy craters with any shock to consumer confidence. But healthcare services are a necessity. Patients may postpone elective procedures slightly, but the core volume of visits, diagnostics, and treatments remains stable. During the 2008–2009 recession, national outpatient visit volumes still rose year over year. And during COVID-19, while traditional office leasing collapsed, MOB tenants largely held their space—and expanded in select cases.

Institutional capital increasingly recognizes this recession-resilient profile. REITs have continued to overweight healthcare assets in their core-plus portfolios, using them as income anchors. The average lease term in medical offices often 7 to 15 years adds to this durability, giving landlords visibility and predictability in cash flows. Additionally, triple-net lease structures shift maintenance and tax burdens to tenants, protecting investor returns during inflationary periods.

Ultimately, MOBs serve both a social function and a financial one. They deliver essential services to communities and provide investors with a shielded income stream. In an era of heightened volatility—from interest rate shocks to global macro uncertainty—healthcare real estate offers the rare combination of necessity-driven demand and downside protection.

Our portfolio is designed for durability. Healthcare Real Estate Fund offers investors a defensive strategy backed by long leases, insured demand, and stability through economic cycles.

Benefiting from the Shift to Outpatient Care

Healthcare delivery is increasingly moving away from expensive hospital inpatient settings towards more cost-effective and convenient outpatient facilities, directly increasing the demand for medical office buildings and specialized clinics.

The U.S. healthcare system is undergoing a dramatic shift away from traditional inpatient hospitals toward outpatient care, reshaping how and where medical services are delivered. This transformation is not theoretical; it’s structural, widespread, and accelerating. Minimally invasive procedures, advanced imaging technologies, and remote monitoring have enabled surgeries and diagnostics that once required hospital stays to now be safely performed in outpatient settings. As a result, demand for modern, accessible medical office buildings (MOBs) has surged.

Hospitals are increasingly repositioning themselves as acute-care hubs, while off-campus outpatient facilities, particularly those housing ambulatory surgery centers, diagnostic labs, physical therapy suites, and specialty care clinics, handle the bulk of routine care. This trend reduces system costs and improves patient experience, which is why both government and private payers are actively incentivizing outpatient delivery models. In fact, recent CMS data shows outpatient procedures growing nearly twice as fast as inpatient admissions over the last five years.

For real estate investors, this pivot is critical. Outpatient centers are leaner, more scalable, and often located closer to residential zones, offering improved site access and higher lease absorption. Long-term lease structures are common, and tenants—whether physicians, healthcare systems, or specialty providers—often invest significant capital in build-outs, ensuring strong renewal probabilities. In high-growth markets, MOBs leased to outpatient providers are now commanding pricing and cap rate compression once reserved for institutional office or retail assets.

Moreover, because outpatient facilities represent the future of care delivery, they are better aligned with healthcare innovation, such as remote diagnostics, modular surgical systems, and AI-assisted triage. Investing in this shift means positioning your capital at the forefront of healthcare evolution.

By partnering with Healthcare Real Estate Fund, you gain exposure to the long-term tailwind of outpatient care, where procedures are growing, reimbursement is flowing, and the built environment must adapt to meet accelerating demand.

Provides Stable and Reliable Income Streams.

Healthcare Real Estate Fund properties are secured with long-term leases with credit-worthy tenants, to established medical practices. This contributes to predictable and consistent rental income for property owners.

Cash‑flow stability is the defining hallmark of medical office investments. Most healthcare tenants—whether hospital‑affiliated physician groups, ambulatory surgery center operators, or specialty clinics—sign long initial terms of seven to fifteen years, often with multiple five‑year extensions. Because medical build‑outs are capital‑intensive (exam‑room plumbing, imaging suites, surgical infrastructure), providers rarely relocate once installed; renewal probabilities consistently exceed eighty percent. Leases are commonly structured on triple‑net or absolute‑net terms, shifting taxes, insurance, and maintenance to the tenant and insulating owners from rising operating expenses. Annual escalations—typically two to three percent—provide built‑in rent growth that compounds steadily over time, acting as a hedge against inflation.

During economic disruptions, these features translate into dependable collections. Industry data show that even through the 2020 pandemic, nationwide MOB rent receipts stayed above ninety‑five percent, outperforming multifamily, office, and retail by wide margins. Investment‑grade health systems, publicly traded surgery‑center chains, and physician networks backed by private equity contribute strong covenant strength; many leases include parent guarantees, further reducing credit risk. Lenders recognize this durability, which is why medical office loans have some of the lowest default rates in commercial real estate. As a result, capitalization rates for stabilized assets remain compressed relative to traditional offices, yet still deliver attractive spreads above core multifamily in gateway markets.

For investors migrating from sectors more sensitive to consumer sentiment, these healthcare income characteristics offer a powerful counterweight. Portfolio models that blend medical office with cyclically exposed assets demonstrate lower volatility and smoother dividend distributions, helping sponsors meet yield targets even when broader markets retrench. Add to that the demographic tailwinds—aging populations necessitating higher visit volumes—and you have a compelling recipe for predictable, long‑term cash flow.

Healthcare real estate is essentially leased to life’s permanent necessities, not discretionary preferences, which locks in both occupancy and pricing power.

By partnering with Healthcare Real Estate Fund, you capture a stream of long‑term, inflation‑hedged cash flow underpinned by credit‑worthy medical tenants, positioning your capital for steady income, quarter after quarter.

Strong & High Occupancy Rate

The combination of growing demand, limited speculative supply, and the specialized nature of the facilities often results in consistently high occupancy levels, reducing vacancy risk for investors.

Medical office buildings consistently post some of the tightest occupancy metrics in commercial real estate. National vacancy fell below ten percent in 2024 its lowest level in more than a decade and primary markets now average well above ninety percent occupancy. In Boston, Houston, Dallas, New York, and Washington D.C., vacancy for Class A medical office hovers in the low‑ to mid‑single digits, with many hospital‑adjacent assets functionally full. Even secondary Sun‑Belt metros such as Orlando, Phoenix, and Raleigh report absorption outpacing new deliveries for six consecutive quarters, despite population growth demanding additional space.

Three forces underpin this resilience. First, patient volumes are rising faster than new construction can keep pace; outpatient visits grew roughly four percent year‑over‑year in 2024 while the development pipeline represented less than three percent of standing inventory. Second, lenders generally require pre‑leasing before financing, which keeps speculative supply in check and prevents the overbuilding cycles common in traditional office. Third, healthcare tenants invest significant capital often two‑hundred dollars per square foot or more—into specialized build‑outs that cannot be replicated in generic space, making relocation costly and unlikely.

During economic slowdowns high occupancy persists. Across the 2020 pandemic, national MOB vacancy inched up less than fifty basis points and fully recovered within twelve months, whereas general office vacancy widened by more than three hundred. Occupancy stability also translates into stronger rent growth: average asking rents for fully leased Class A medical office rose nearly two percent in 2024, outperforming inflation‑adjusted gains in retail and conventional office sectors. For investors, this tight occupancy profile lowers lease‑up risk, supports predictable cash flows, and enhances property valuations, especially when interest‑rate headwinds pressure more volatile asset classes.

The combination of needs‑based demand, disciplined supply, and costly tenant improvements creates occupancy stickiness unmatched elsewhere in commercial real estate.

Investing with Healthcare Real Estate Fund places your capital in facilities that historically operate at 90 percent‑plus occupancy, delivering dependable revenue and minimizing downtime.

Supply Constraints and Low Speculative Development

Unlike some other commercial real estate sectors, new healthcare real estate development, particularly MOBs, is typically built only when significant preleasing is secured. This disciplined approach limits oversupply and supports the value of existing properties.

Medical office supply grows at a deliberately measured pace, a direct consequence of healthcare’s specialized requirements and conservative capital stack. At mid‑2025 the national pipeline under construction represented barely two‑percent of existing inventory—roughly half the proportion seen in conventional office and industrial sectors. Of that modest pipeline, nearly seventy percent was already pre‑leased before the first shovel hit the ground, reflecting lender mandates that healthcare projects secure anchor tenants—often health‑system sponsors—long before financing closes. Banks typically insist on fifty‑to‑seventy‑five percent pre‑leasing for MOB construction loans, compared with twenty‑to‑thirty percent for suburban office developments, effectively eliminating speculative oversupply.

Cost and complexity further restrain new entrants. Outfitting an MOB capable of hosting imaging suites or ambulatory surgery centers can exceed four‑hundred dollars per square foot—double the build‑out cost of generic office space—while landlord turnkey allowances often reach eight figures for large tenants. Regulatory hurdles amplify the barrier: certificate‑of‑need statutes in many states still govern imaging or surgical facilities, adding time and uncertainty to new development. Even in states that recently eased CON rules, health‑system partnerships remain the norm, ensuring projects are need‑based rather than speculative.

Construction‑cost inflation has also kept new starts in check. Steel, electrical components, and specialized medical gas systems saw cumulative price rises of roughly thirty percent between 2020 and 2024, prompting developers and their capital partners to pursue only the most strategically located, pre‑committed sites. Consequently, the majority of MOB deliveries occur adjacent to existing hospital campuses or in rapidly growing suburban submarkets where demographic data confirm demand. Older, functionally obsolete office buildings rarely convert to medical use because ceiling heights, column spacing, and mechanical systems can’t economically accommodate clinical infrastructure—another natural brake on supply expansion.

The result for investors is a structurally undersupplied environment that supports rent growth and protects valuation. When new space arrives it typically debuts near full occupancy, while existing properties benefit from spill‑over demand. Vacancy spikes that plague other property types after a construction boom are exceedingly rare in healthcare real estate, reinforcing the sector’s reputation for durable performance.

Aligning with Healthcare Real Estate Fund positions your capital in a sector where disciplined, need‑based development keeps competition thin and rental pricing power strong.

High Tenant Stability (“Sticky” Tenants)

Healthcare tenants, especially those with specialized build-outs and established patient bases, face significant disruption, cost, and potential loss of clientele if they relocate. This makes them less likely to move, resulting in longer tenant tenure.

Medical office tenants are famously reluctant to move. The foremost reason is cost: in 2024 the average interior build‑out for a standard physician suite reached roughly $450 per square foot, while specialty clinics with imaging or procedure rooms routinely exceeded $600 per square foot. Providers amortize those improvements over the initial lease term, so relocating early would force them to write off a substantial investment and finance a second build‑out elsewhere.

Patient loyalty compounds the inertia. Practices cultivate referral networks and neighborhood visibility over many years; disrupting those touchpoints quickly erodes revenue. Industry surveys conducted in mid‑2024 found that more than 82 percent of medical office tenants renewed at lease expiration. By contrast, conventional office landlords saw barely 42 percent of expiring leases roll into renewals the same year. The disparity highlights just how “sticky” healthcare tenancy is.

Regulatory hurdles make relocation even less appealing. Ambulatory‑surgery centers or imaging suites that change address must secure new state licenses, Medicare certification, and payer contracts—a process that can stretch six to twelve months and jeopardize cash flow. Consequently, most operators exercise embedded renewal options, typically five‑year increments with two‑ to three‑percent annual escalations.

For investors, this structural immobility yields three distinct benefits: exceptionally high renewal probability, minimal downtime and re‑tenanting expense, and predictable rent growth driven by contractual bumps rather than risky mark‑to‑market plays. The result is a cash‑flow profile that stays steady even when other property types battle churn.

Partnering with Healthcare Real Estate Fund means owning properties whose tenants are financially and operationally committed to staying in place, turning “sticky” occupancy into long-term peace of mind.

Portfolio Diversification Benefits

Healthcare real estate often has a low correlation with the performance of other traditional real estate sectors (like office or retail) and broader economic cycles, making it a valuable tool for investors looking to diversify their portfolios and potentially reduce overall risk.

Healthcare real estate delivers return patterns that differ materially from every “core four” property type—office, retail, industrial, and multifamily—making it a powerful diversifier inside mixed portfolios. NCREIF’s expanded Property Index, which began breaking out health‑care assets as a standalone category in 2024, shows that medical office and senior‑housing properties produced a positive 4‑percent total return for the twelve months ending first‑quarter 2025, even as the broader index was negative because of office write‑downs. Looking back ten years, quarterly correlations between healthcare property returns and the other core sectors sit in the low‑to‑mid‑0.60s, versus correlations above 0.80 among the traditional sectors themselves. The relationship with public‑equity markets is even looser: healthcare REIT total returns have averaged a 0.40 correlation to the S&P 500 over the past decade, while apartment and office REITs routinely post correlations in the mid‑0.60s.

Low cyclicality drives that disconnect. Revenues depend on insurance‑funded, nondiscretionary medical care, not consumer sentiment or freight volumes. During 2023‑2024, when e‑commerce normalization softened industrial absorption and hybrid work pressured office demand, national medical‑office vacancy fell below ten percent and rent collections exceeded ninety‑five percent—providing income stability that offset volatility elsewhere in real‑asset portfolios.

The diversification story becomes clearer when juxtaposed with headwinds now facing other sectors. Multifamily syndicators in 2025 are wrestling with higher floating‑rate debt costs, insurance premiums up as much as thirty to fifty percent year on year, and localized oversupply in several Sun‑Belt metros. Many sponsors have paused distributions or undertaken capital calls to shore up debt‑service coverage. Healthcare landlords, by contrast, operate on fixed‑rate debt more frequently, enjoy triple‑net leases that pass through expenses, and benefit from tight supply pipelines that keep occupancies above ninety percent.

Because healthcare real estate moves to its own cadence driven by demographics and medical necessity rather than the business cycle—allocating even a modest share of portfolio capital to the sector can measurably dampen volatility without sacrificing total return. It is one of the few property types demonstrating positive income growth and capital‑value resilience in today’s late‑cycle environment.

Investing with Healthcare Real Estate Fund injects true diversification into your holdings, balancing cyclical sectors with the steady pulse of healthcare‑backed income.

Growth Opportunities in Primary & Secondary Markets.

Population migration and demographic shifts are driving healthcare demand and facility expansion in numerous primary, secondary, and suburban markets, offering targeted investment opportunities in areas with strong underlying fundamentals.

Demographic migration is redrawing the U.S. healthcare landscape—and with it, the map of the most attractive real‑estate opportunities. Census Bureau 2024 estimates show that Texas and Florida alone absorbed roughly 770,000 net new residents in the prior twelve months, the two largest absolute gains in the nation. Arizona, the Carolinas, and Tennessee round out the top tier, each logging population growth above 1.5 percent—more than double the national pace. Those inflows translate directly into heightened demand for outpatient care. CBRE’s 2025 Healthcare & Life Sciences Outlook ranks Dallas–Fort Worth, Houston, Phoenix, Orlando, and Charlotte as the five metros with the greatest near‑term need for new medical office square footage, based on projected patient‑visit growth and limited on‑campus supply.

Secondary “medicine hubs” in the Midwest and Mid‑Atlantic are also outperforming. JLL’s Q1 2025 Healthcare Real Estate Perspective highlights Nashville, Raleigh‑Durham, Columbus, and Kansas City as markets where medical office vacancy sits below six percent while average asking rents climbed three to four percent year‑over‑year well above the national MOB average of roughly two percent. These metros benefit from university‑anchored health systems, burgeoning life‑science clusters, and business‑friendly tax regimes that draw both patients and providers.

Within primary gateway markets, suburban sub‑clusters are delivering outsized absorption. Cushman & Wakefield’s 2024 snapshot notes that Long Island, Northern Virginia, and Chicago’s western suburbs each recorded more than 300,000 square feet of net MOB absorption in 2024, driven by hospitals extending outpatient footprints closer to affluent residential catchments. Because ground‑up supply in these infill areas is constrained by land costs and zoning, investors have gravitated toward conversion and sale‑leaseback opportunities often locking in cap rates 25 to 50 basis points inside national averages.

Finally, growth‑market cap‑rate spreads remain enticing versus gateway pricing. Data from MSCI Real Assets show that stabilized MOBs in Phoenix and Tampa closed at an average 120‑basis‑point premium to comparable assets in Boston or New York during 2024, offering yield without sacrificing tenant quality or occupancy. Taken together, population in‑migration, payer mix improvements, and constrained pipelines create fertile ground for targeted, geography‑specific deployment of capital.

Aligning with Healthcare Real Estate Fund channels your capital into the very metros where population surges and undersupplied outpatient networks are pushing rents and values steadily higher.

High Barriers to Entry

The technical requirements for building, operating, and maintaining healthcare facilities (e.g., specialized HVAC, plumbing, regulatory compliance) are complex and costly. This creates higher barriers to entry compared to general commercial properties, limiting competition from less experienced investors or developers.

Designing, constructing, and operating medical office buildings involves a level of complexity rarely encountered in conventional commercial projects. Specialized HVAC systems must deliver a minimum of six to fifteen air changes per hour in procedure and imaging suites, while maintaining strict temperature and humidity tolerances dictated by the Facility Guidelines Institute. Medical gas lines, lead‑shielded walls, slab reinforcement for heavy equipment, and redundant electrical feeds with emergency‑power transfer switches are likewise standard requirements. As a result, ground‑up MOB construction averaged roughly $550 to $650 per square foot in 2024, more than double the cost for Class A suburban office shells.

Regulatory oversight adds another layer of difficulty. In California, the Office of Statewide Health Planning and Development (OSHPD) can extend plan‑review cycles to twelve or eighteen months for projects housing ambulatory surgery centers or high‑acuity imaging. Many Mid‑Atlantic and Southern states still require Certificate‑of‑Need approval for diagnostic equipment or operating rooms, a process that can take upward of a year even before building permits are filed. On the operational side, clinics must comply with federal standards from the Centers for Medicare & Medicaid Services, National Fire Protection Association life‑safety codes, and increasingly stringent state infection‑control regulations—each triggering periodic inspections and documentation that inexperienced owners often underestimate.

Financing hurdles reinforce the moat. Most lenders insist on pre‑leasing of 50 to 70 percent before funding vertical construction, a threshold well above typical office or industrial requirements. They also underwrite tenant‑improvement allowances that can reach eight figures for a single project, demanding sponsors with deep balance sheets or proven healthcare joint‑venture partners. Together, these technical, regulatory, and capital barriers keep opportunistic or inexperienced developers on the sidelines, protecting incumbent owners from sudden waves of speculative supply and price‑undercutting competition. For investors, the net effect is an asset class that enjoys both demand resilience and supply discipline—the twin pillars of sustained cash‑flow growth.

Aligning with Healthcare Real Estate Fund places your capital behind a formidable moat of technical, regulatory, and financial barriers shielding returns from low‑barrier competition.

Growing Institutional and Private Investor Interest

Increasing investment from large institutional funds and sophisticated private investors signifies confidence in the sector’s performance and potential, potentially leading to greater liquidity and market recognition.

Capital is flowing into healthcare real estate at a pace few other property types can match. CBRE’s 2024 year‑end U.S. Healthcare & Life Sciences Capital Markets report estimates that medical office building (MOB) sales reached roughly $9 billion in 2024, a 25 percent rebound from the rate‑shocked lows of 2023. Average deal pricing climbed to about $290 per square foot, and cap rates ticked down for the first time in two years—evidence that buyers now view the sector as a safe haven amid broader market uncertainty.

Importantly, the buyer mix is deepening. The same CBRE survey shows private investors captured 52 percent of 2024 healthcare acquisitions, while institutional capital—pension funds, insurance companies, and sovereign wealth vehicles—accounted for another 30 percent. That balance signals widespread conviction rather than a niche trade. Public healthcare REITs have re‑entered growth mode as well; Green Street Advisors projects those REITs will raise approximately $85 billion of new capital in 2024, positioning them to chase large portfolio trades and forward‑funded developments through 2025.

Private equity is equally active. According to Preqin’s 2025 Alternatives in Healthcare Real Estate outlook, dedicated healthcare funds closed on more than $11 billion of dry powder in 2024, with several single‑fund targets exceeding one billion dollars. At the same time, the middle market remains vibrant: half of all 2024 MOB transactions were single‑asset trades under $20 million, illustrating that institutional participation has not crowded out private funds and investors. Greater research coverage, growing lender familiarity, and the sector’s defensive cash flows have collectively boosted liquidity and exit optionality key indicators of a property class maturing into the mainstream.

By partnering with Healthcare Real Estate Fund, you gain access to a sector where billion‑dollar institutions are driving values—yet our vehicle lets private investors participate on equal footing, capturing institutional‑grade upside without writing institutional‑sized checks.

Alignment Economics Execution

This is what makes a Responsible Real Estate Investment and Healthcare Real Estate Fund strikes the balances Limited Partners Expect

Alignment

Every offering we structure begins with a meaningful co‑general‑partner (“co‑GP”) capital commitment, invested on the exact same terms as our Limited Partners. Our compensation model then tilts decisively toward performance:

- Above‑Market Preferred Return (“Pref”) – LPs earn a 11.5% cumulative–non‑compounding pref before the GP is eligible for any incentive. Most private healthcare‑real‑estate vehicles quote an 8 % pref; we deliberately set ours higher to underscore that investors get paid first.

- Single‑Tier Promote – Once the 10 % pref is satisfied, profits flow through a single split. No multi‑tier waterfalls and no “catch‑ups” that dilute LP upside.

- Lean, Transparent Fees – Each fee is benchmarked to third‑party CRE surveys and kept at or below industry averages. There are no disposition, refinance, construction‑management, or other ancillary add‑ons that quietly chip away at returns.

- Co‑GP Capital at Risk – Our own equity remains invested until final exit; we harvest gains only after LP capital is returned and pref hurdles are met.

- Institutional Governance – Quarterly reporting, third‑party audits, and independent annual valuations ensure full transparency and an LP‑first oversight framework.

Together, these elements align incentives, reward true outperformance, and protect investor capital—exactly the structure sophisticated LPs look for when assessing an emerging sponsorship team.

Economics & Exit

We acquire stabilized, triple‑net medical office and outpatient care properties leased to credit‑worthy providers. This sub‑sector historically maintains occupancies above 90 percent and exhibits rent growth that keeps pace with CPI—all while avoiding the heavy capital‑expenditure drag common to hospitals. Conservative leverage and a short, three‑to‑four‑year hold period aim to deliver an attractive ratio of current cash flow to total return, giving investors near‑term income and equity growth without decade‑long lock‑ups.

Programmatic DST‑1031 Exit Strategy

Each asset is pre‑modeled for disposition into a Delaware Statutory Trust (DST) under Section 1031. The DST market raised nearly $5.66 billion of equity in 2024—a 15 percent year‑over‑year gain—and logged more than $600 million in January 2025 alone, underscoring robust, ongoing demand for tax‑deferred replacement property. Converting stabilized fund assets into individual DST offerings delivers three advantages:

- Accelerated Liquidity for Fund Investors – Selling into the active DST marketplace shortens marketing time and speeds cash distributions back to the fund. Liquidity is the core benefit for fund LPs; the tax deferral belongs to the downstream DST buyer.

- Pricing Power – Fractional DST buyers typically accept slightly lower cap rates than institutional purchasers, translating to higher sale proceeds for fund investors.

- Repeatable Capital‑Recycling Engine – Each DST sale broadens our relationships with 1031 intermediaries and wealth‑management channels, creating a ready pool of future buyers. This ecosystem supports faster capital redeployment into the next acquisition cycle—ultimately benefiting both current and future fund investors.

Execution

Responsible Real Estate Investment, LLC (“RREI Partners”) as the General Partner of Healthcare Real Estate Fund II, LP leadership team blends three complementary skill sets:

- Physician‑Anchored Capital & Strategic Vision – One principal is a retired surgeon who directs a private family‑office portfolio exceeding $100 million across real estate, operating companies, and early‑stage ventures. That clinical perspective unlocks proprietary tenant relationships and ensures every acquisition is evaluated through both a medical‑operations and investor‑returns lens.

- Institutional‑Grade Underwriting & Capital Structuring – Team members have collectively executed $4 billion‑plus of commercial‑real‑estate and corporate‑finance transactions. Backgrounds span private equity capital markets national net lease brokerage, credit‑tenant underwriting, and private‑equity capital markets. Each investment model is built with conservative leverage, fixed‑rate debt, and stress‑tested exit scenarios from day one.

- Technology‑Enabled Deal Origination & Investor Engagement – Our team has built and scaled a cloud‑based commercial real‑estate marketplace that connected tens of thousands of brokers & users across nearly fifty countries, generating a proprietary flow of $1.8T in CRE opportunities. On the capital side, prior experience in digital outreach raising more than $150 million from retail investors for a boutique healthcare/seniorcare real estate fund(s) placed in over $500M in total developments and acquisitions translates into best‑in‑class digital outreach and data‑driven marketing campaigns.

Together, Healthcare Real Estate Fund II, LP & RREI Partners deliver the execution muscle of an established institutional sponsor—origination reach, disciplined underwriting, and tech‑enabled asset management—while preserving the entrepreneurial agility that lets an emerging GP seize niche opportunities in stabilized medical NNN assets.

Healthcare Real Estate Fund II Limited Partners receive quarterly distributions targeted at 4 % – 5 % annually, supported by long‑term triple‑net leases to credit‑worthy healthcare providers. A 11.5 % preferred return ensures you get paid first, while a targeted 12 % – 13.25 % IRR captures the upside of a sector that historically outperforms through every economic cycle.